Advanced Guide For High-Income Business Owners

💵YEAR-ROUND TAX SAVINGS BLUEPRINT!

Stop Treating TAX PLANNING Like a Once‑a‑Year Chore

🤔Why You Need This Blueprint Now?

Most business owners only think about taxes after the year is over. By then, it’s too late to make meaningful changes.

This guide helps you catch up and stay ahead using compliant, legal strategies backed by proper documentation.

This is not a DIY tax checklist. It’s a proactive tax strategy insights guide from a team of Certified Tax Coaches, Enrolled Agents, Certified Tax Resolution Specialists, and CPAs with 60+ years of combined experience who do this every day to help business owners like you.

🔎What's Inside?

Personalized Snapshot of Missed Deductions, Timing Plays, and Entity Tweaks:

A 13-point “Tax Leak” scan to spot hidden waste

️Entity structure check (S-Corp vs. Partnership vs. C-Corp)

Timing strategies for purchases, bonuses, and benefits

Salary vs. distribution optimization analysis

First-year savings projection tailored to your business

Credit and incentive review based on current IRS guidance

BONUS: Year-End Tax Prep Checklist

Total value: $2297

Get it NOW for only $27

BEFORE TAX STRATEGY:

The Uncertainty & Stress You Live With

You’re unsure what your tax bill will be until it’s too late to change it

You 're told what you owe, not what you could have saved

You scramble every April, hoping you remembered everything

Tax season feels reactive, rushed, and risky

You rely on a CPA who “files” but doesn’t “plan”

Your business structure hasn’t been revisited in years

After TaxAce:

Confidence, Clarity, Control and Growth

You know your tax game plan months before year-end

Every decision, payroll, purchases, distributions is made strategically

You see tax season as an opportunity, not a threat

Your entity and salary setup support your financial goals

You’re backed by Certified Tax Professionals who bring ideas, not just forms

You have documentation, projections, and proactive support

Your tax savings aren’t a hope. They’re calculated

TaxAce: Your Trusted Partner for Smart, Year-Round Tax Strategies

Led by Nataly Zamora, founder and CEO of TaxAce with over two decades of experience, we help business owners reduce tax stress and KEEP MORE OF WHAT THEY EARN!

TaxAce is a California-based tax planning firm with a team of Certified Tax Coaches, Enrolled Agents, Certified Tax Resolution Specialists, and CPAs.

We are federally licensed and serve clients in all 50 states, across all industries, guided by the latest tax laws and multi-state compliance.

We don’t just file your taxes.

We help you understand and educate you on how they actually work.

💵$26Million+

Total Client Tax Savings to Date

🚀25+ Years

Years Serving Business Owners in All Industries

🏆Best of 2024

Voted for Best Tax Firm & Financial Services

💼1,000+

Business Clients Served Nationwide

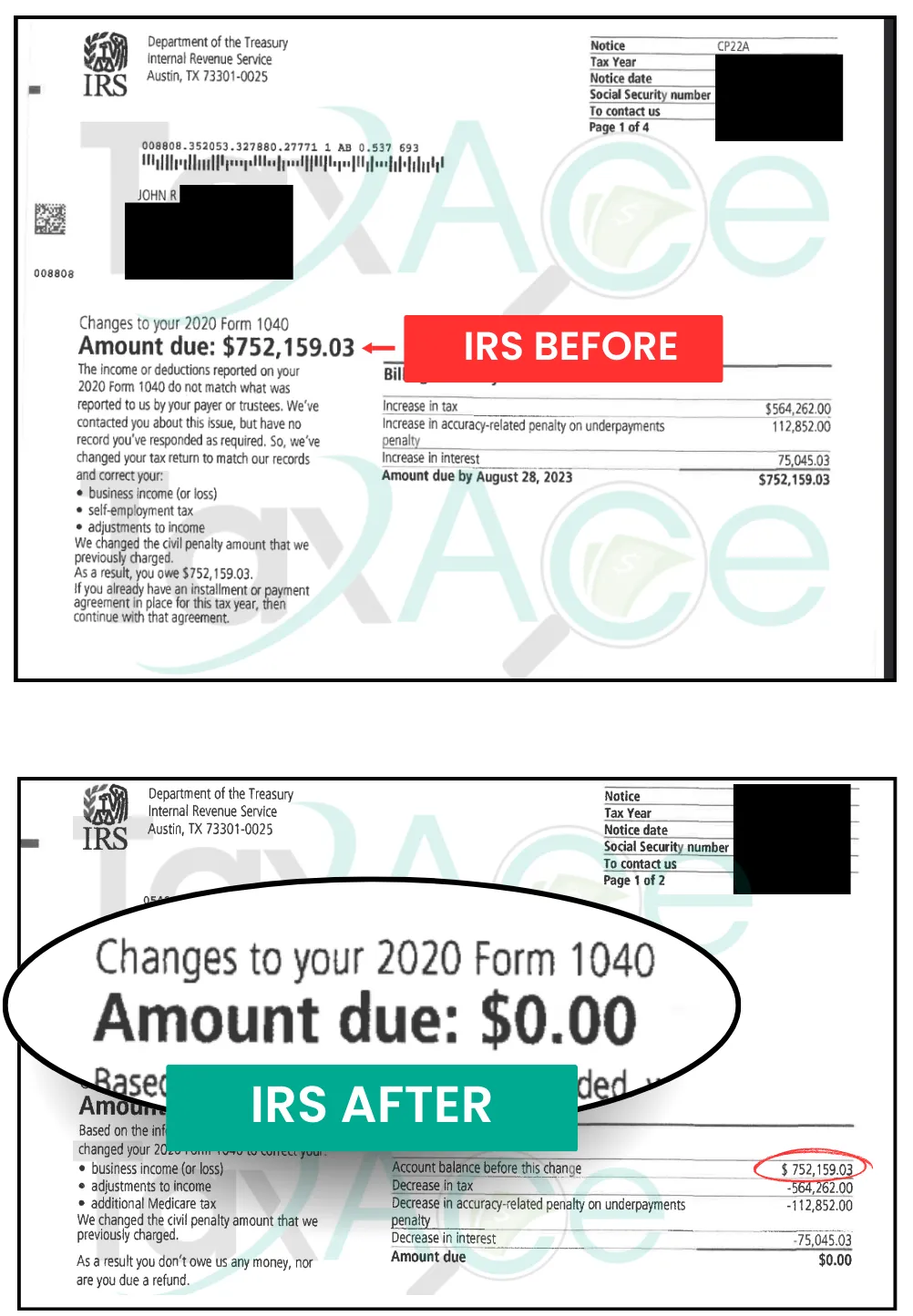

TaxAce SAVED John Over $752,000

John faced a large IRS bill because his prior tax professional failed to plan ahead or respond to key tax law updates.

He had never revisited his entity structure or optimized his tax strategy since the business was established. Without proactive planning, his business remained stagnant.

This real client case shows what’s possible with expert-led tax strategy. We discovered multiple errors that a business owner should never make. These mistakes had triggered huge penalties for his company.

Through comprehensive planning and compliance-focused adjustments, we completely reversed his situation. His IRS liability dropped from over $752,000 to $0.

This outcome was not luck, it was the result of precision, expertise, and the right guidance applied at the right time.

“Money Talks.

But Tax Strategy Whispers Wealth. ”

Frequently Asked Questions

Is this really $27 only?

Yes. For a limited time, you can get the full blueprint for only $27.

That's a 98.8% value for money discount. It is designed to help you avoid costly tax mistakes and make smarter decisions before year end.

Just clear, strategic guidance for business owners.

What if I already have an accountant?

That’s totally fine. Many of our clients come to us while still working with their existing accountant. The difference is that our focus is on proactive planning, not just preparing returns.

This guide gives you strategy insights that can complement your current setup. And if you ever want hands-on support to implement what’s inside, we’re here to help you build a plan that works with or beyond your existing team.

How can I contact you?📍📞📧

You can reach us in whichever way is most convenient for you:

Main Office:

4820 Business Center Dr, Ste 240, Fairfield, CA

Email: [email protected]

Phone: (707) 557-1040

Schedule Your Blueprint Call with Our Client Success Strategist

Proactive Planning and Smart Savings Start with This Guide!

This blueprint is your first line of offense toward smarter savings. It’s built for business owners who want clarity, control, and compliance without the last-minute scramble. Inside, you’ll discover how to align your entity, plug tax leaks, optimize timing for expenses, and identify credits that others overlook.

The best tax savings don’t happen by accident. They start with strategy.

Now’s your chance to plan ahead, protect your profits, and make informed moves before year-end.